Scan this article:

Hey Superheroes,

If 2023 was the year of Artificial Intelligence (A.I.) Hype then 2024 is the year of A.I. Reality.

As we mentioned last week, Nvidia’s revenue has more than tripled over the past 12 months. Companies such as Australian data centre operator NextDC (ASX:NXT) and Elon Musk’s AI Startup xAI have recently raised billions of dollars in capital raises and seed funding.

Brainchip Holdings (ASX:BRN) is also having a good year as it develops and markets its Akida technology. It’s stock price is up 38% YTD.

Here are this week’s stories.

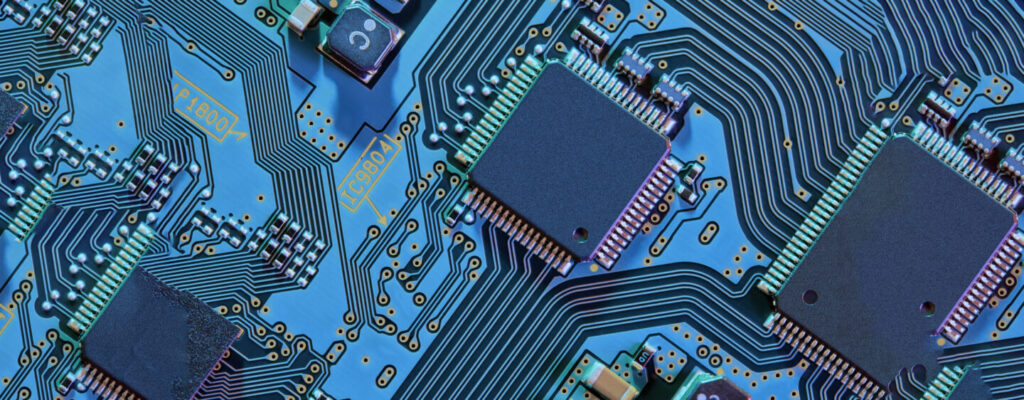

Trading in AI Stocks has doubled in 2024

On the Superhero platform, compared to the same time last year across a basket of 53 AI Stocks.

That level of growth represents Aussie investors’ huge appetite for companies that are part of the AI wave.

From the ‘Hot Chips Collective’ of Nvidia, AMD Devices, and SuperMicro Computing to software companies like Salesforce and Alteryx, as well as US Big Tech Firms such as Microsoft taking a leadership role in the space, there are plenty of opportunities to gain exposure to this trend.

📝 There’s an ETF for that!

Last month, Global X launched the Global X Artificial Intelligence ETF (ASX:GXAI), an A.I. focussed ETF, allowing investors to target companies poised to benefit from further AI development and those building its infrastructure.

Who’s who of technology companies from IBM to Samsung and Amazon to Meta are in the fund’s portfolio.

🔦 SPOTLIGHT ON MUSK

Just this week, the AI startup that Tesla and SpaceX founder Elon Musk created this past year, xAI, received over US$6bn in a Series B funding round that saw the valuation of the company rise to $24bn.

Nvidia is the main supplier for xAI’s supercomputers, however Musk’s goal to counterbalance AI technologies from Microsoft/OpenAI and Google is likely to keep them on alert.

🏠 Closer to home

This week saw an AI Summit organised by the Australian Financial Review with CBA’s CEO Matt Comyn saying there was “no doubt” that companies like his would look very different in the next decade. Banks like CBA and Westpac have been using generative A.I. in their engineering teams.

Woolworths-owned data science firm Quantium CEO Adam Driussi referenced his other job as chairman of NRL side Canterbury-Bankstown Bulldogs when he said that even coaches of sports teams would have an “AI Assistant Coach”.

The pace and scope of adoption appear to be limitless.

🔦 Some other things we’re shining the Spotlight on:

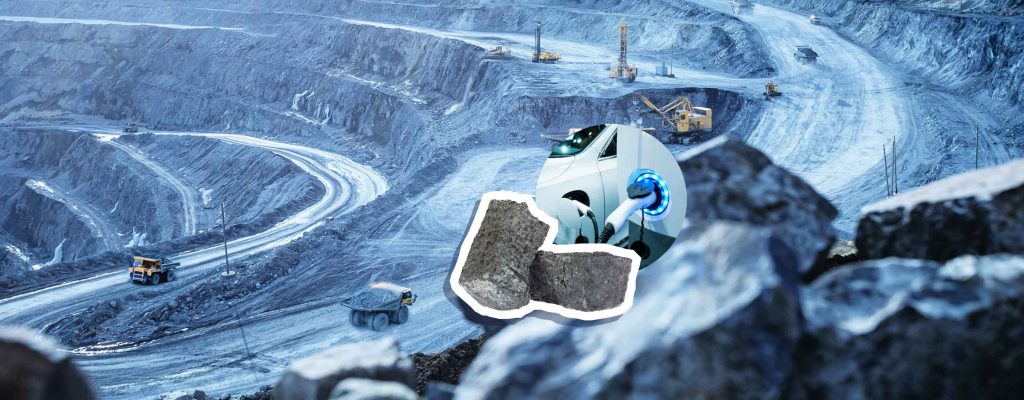

- QUICKSILVER: The recent mega rally in commodities prices has seen Copper and Gold hit new record highs, while Silver has seen an 11-year high. One of the best-performing IPOs on the ASX in the last 2 years to date is the recently listed silver miner Sun Silver (ASX:SS1).

- NETFLIX and NIL: The streaming service pocketed more than $1.1 billion from Australian customers last year but has shifted more than 92% overseas to its US parent company. It has also announced that it would stop reporting its quarterly subscription numbers.

- FEELS LIKE HOME TO ME?: Construction and property management company Lendlease (ASX:LLC) has announced a radical change in strategy with a plan to divest $4.5bn in overseas assets as it concentrates on its home operations. It plans on doing more than half of this by June 2025.

Finally – we have two new stocks hitting the ASX next week so keep an eye out on our social media channels to find out more.

That’s all for this week’s Spotlight!

Keep up to date by following us on Instagram, @superheroau!

Become a part of

our investors' community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.