Scan this article:

Hey Superheroes,

What an eventful week! The AUD reached a 16-week high, ChatGPT turned 1, Elon Musk had some colourful words for Disney CEO Bob Iger and Warren Buffett’s partner-in-crime Charlie Munger passed away at 99. 😢

It’s also been extra exciting at Superhero HQ… we just unveiled our shiny new website earlier today! Do drop by for some imaginary virtual tea. ☕

Here’s the most interesting stories from the week.

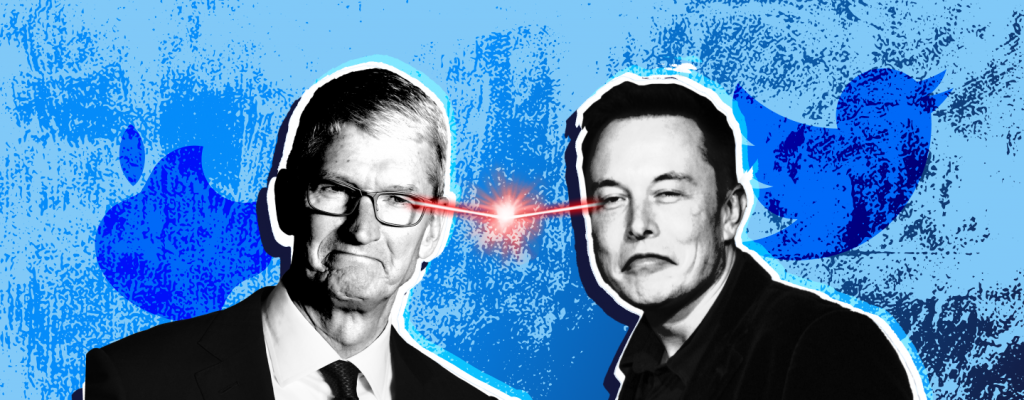

Apple wants to end partnership with Goldman Sachs

Even two global behemoths can break up.

Apple and Goldman Sachs teamed up in 2019 with the goal of breaking into the flourishing fintech sector.

Together, they released an Apple-branded credit card, a buy now pay later product and a high-yielding savings account known for returning 10 times the average rate.

But despite inking the partnership until 2029, it sounds like Apple now wants out – after just four years.

💳 Apple Card?

Don’t be surprised if you’d never heard of the Apple Card before.

The one-of-a-kind titanium credit card was only ever offered in the U.S. where it won customers over with its low fees and 3% cashback offer.

Within just two years, the Apple Card’s user base had already expanded to 6.4 million customers. That’s nearly a quarter of Australia’s population!

😬 It was a rocky relationship

Despite Goldman Sachs’ CEO once lauding the Apple Card for having “the most successful credit card launch ever,” the venture has been difficult for both sides.

Apple has been unhappy with Goldman Sachs’ level of customer service, which had issues like customers finding it difficult to withdraw money and females getting lower credit limits despite higher credit scores. Even Apple CEO Tim Cook’s Apple Card application got denied at first.

On the other side, the Apple Card was the bane of Goldman Sachs’ financial statements. Between 2019 and 2022, the global bank was estimated to have lostspent between US$1 billion to US$3 billion on the Apple Card, without yet generating a profit.

There were also reports that Goldman Sachs was actually looking to pass on its Apple Card partnership to American Express earlier this year.

🍎 The takeaway?

Neither Goldman Sachs nor Apple have confirmed or denied the report.

While Goldman Sachs may look to lessen its baggage by cutting the partnership off, Apple’s annual reports do not clearly identify how its foray into fintech has affected its financials.

There’s also the question of whether American Express will finally get back into the picture. Stay tuned.

Fun Fact:

The seven largest companies in the S&P 500 returned an average of 94% this year. In comparison, the S&P 500 only returned 18%. Can you guess what the seven companies are?

Shein, Reddit and Skims – the IPOs of tomorrow

Shein made headlines this week after filing for a Wall Street debut. But it’s not the only comp expected to be on the IPO stage for next year.

Here’s a quick FAQ on our 2024 IPO hopefuls:

🛍️ Shein

-

- What it is: A fast-fashion company founded in China in 2012. It’s since moved its headquarters to Singapore and caters to customers globally.

- Potential IPO date: Sometime in 2024.

- Estimated valuation: US$90 billion.

- Why it matters: Shein has taken approximately 18% market share of the global fast-fashion industry, beating Inditex (parent company of Zara), H&M and Primark. It has the potential to become the biggest U.S. listing by a Chinese-founded company.

-

- What it is: Founded in 2005, Reddit has grown to become a global social media giant with over 430 million monthly active users.

- Potential IPO date: Q1 2024.

- Estimated valuation: US$15 billion.

- Why it matters: Reddit considered an IPO back in 2021 at a valuation of US$10 billion, but it did not go through.

👖 Skims

-

- What it is: Skims is a clothing brand founded by Kim Kardashian in 2019. It has since grown into a billion-dollar business.

- Potential IPO date: Unconfirmed with rumours of 2024.

- Estimated valuation: US$4 billion.

- Why it matters: Despite being a young company, Skims has begun generating profits and is backed by various funds. It also benefits from the influencer power of the Kardashian name.

🔦 Some other things we’re shining the Spotlight on:

THE OECD’S CRYSTAL BALL: The OECD just released its economic outlook for Australia, noting that the RBA may finally be done with its rate hiking cycle. It expects the central bank to sustain the 4.35% before implementing 75bps worth of rate cuts beginning Q3 2024.

THE (GOOGLE) PURGE: Hold anything special in your dusty old Google account? If yes, you’d want to know this. Following its updated inactive account policy released in May, Google will finally begin purging accounts that haven’t been used in the last two years later today.

TEMPLE AND WEBSTER’S BIG WIN: Temple and Webster shares surged over 20% this week after posting a 27% year-on-year increase in sales between July and November. The retailer’s Black Friday and Cyber Monday sales also doubled those of last year.

That’s all for this week’s Spotlight!

Happy 1st of December!

Become a part of

our investors' community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.