Scan this article:

Hey Superheroes,

Global markets have been a rollercoaster this week following the Fed Governor’s comments of rate cuts being further away than expected.

Meanwhile, U.S. quarterly earnings season is now in its second week with several big banks having reported in the last few days. Next week will see some big tech names like Tesla, Netflix and Intel release earnings for the quarter.

Let’s get on with it.

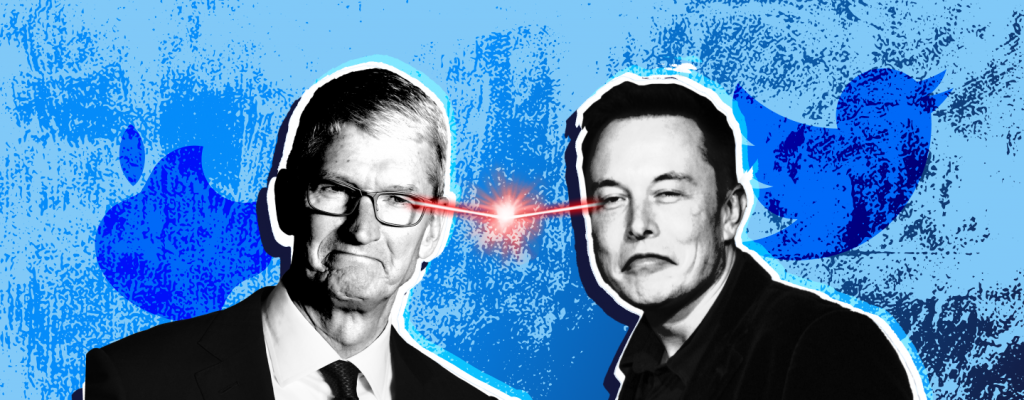

Apple is now the world’s top seller of smartphones

When you think of a smartphone brand, what do you think of? The majority of Aussies and Americans would say Apple first but Samsung has maintained a stranglehold in other regions – particularly Europe and Asia – for years.

However, after 12 long years, Apple has finally overtaken Samsung as the world’s top seller of smartphones.

🍎 Barely made it

Despite global smartphone demand hitting a decade low, Apple was able to take a significant share of the market from its rival – growing from 18.8% in 2022 to 20.1% last year. Contrarily, Samsung’s market share dropped from 21.6% to 19.4%.

It was just a shake up for the top of the table though with the next three brands on the list, Xiaomi, Oppo and Transsion, not seeing much of a change to their respective global market share.

In fact, amongst the five brands, only Apple and Transsion saw record sales growth in the challenging year.

This however comes after Apple’s tough decision to discount some of its models by up to 5% in China after facing pressure from Huawei.

Liontown Resources drops 17% after Albemarle’s sell-off

Liontown Resources fell 17% this week after Albemarle (NYSE:ALB) started selling off its stake in the company. The sell off follows Albemarle’s decision to abandon its A$6.6B takeover bid of Liontown back in October.

Many think that the failed deal was all thanks to one person.

💰 Why did Albemarle abandon the deal?

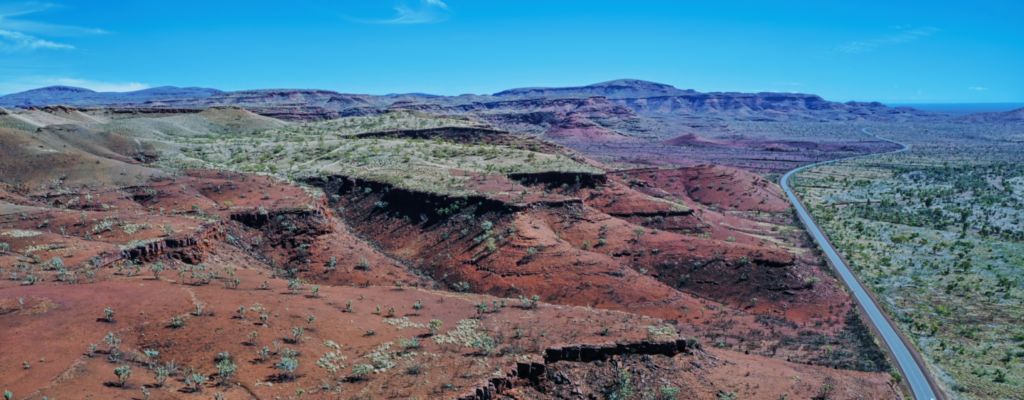

Albemarle and Liontown Resources had been in talks for months, lobbying bids back at each other before finally settling on a takeover offer of A$3 a share in September. The NYSE-listed company had been interested in the ASX miner’s WA Kathleen Valley project which was scheduled to start producing lithium by mid-2024.

Unfortunately for Albemarle, Australia’s wealthiest individual, Gina Rinehart, had other plans. The billionaire had slowly been buying up shares of Liontown Resources, building her stake in the company up to a solid 19.9%.

Albemarle’s acquisition would have come with a caveat that at least 75% of Liontown’s shareholders would need to approve the transaction. With Ms Rinehart having almost enough power to prevent the takeover from happening, Albemarle decided to pre-emptively cancel its bid.

🔦 Some other things we’re shining the Spotlight on:

- URANIUM’S ROAD TO 100: Uranium prices have reached US$100 for the first time in over 16 years after Kazatomprom, the world’s largest producer of the mineral from Kazakhstan, warned that it would fall short of production targets.

- APPLE GETS BITTEN: While Apple celebrates its smartphone win, it’s still facing an uphill battle to get Apple Watches back on U.S. store shelves.

- REDDIT MARCHES IN: Reddit is now reportedly eyeing an IPO by March this year. If it pushes through, it will be the first social media platform to debut on the markets since Pinterest in 2019.

Next Wednesday will also see the release of Australia’s employee earnings data. These stats are only released every two years so it’s time to see if wages have kept up with inflation! And also, don’t forget that AU markets will be closed on Friday.

That’s all for this week’s Spotlight!

Become a part of

our investors' community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.