Scan this article:

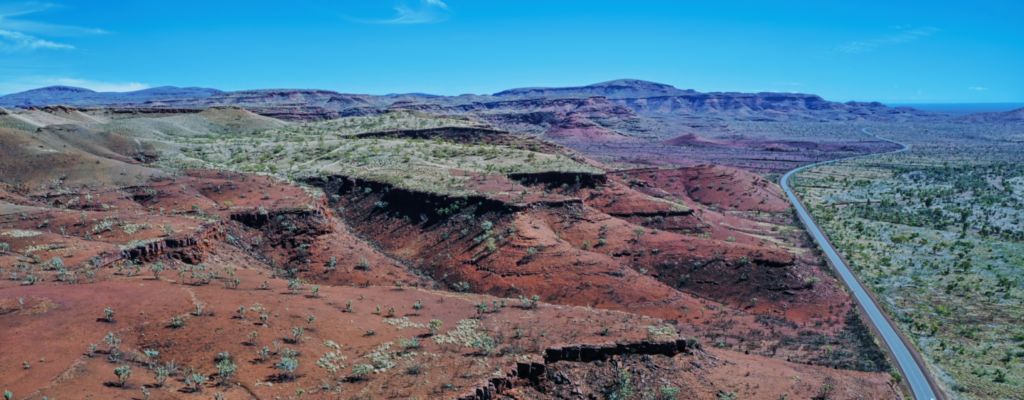

Liontown Resources rejected a $5.5b bid and became the most Googled stock on the ASX this week.

1. Liontown Resources chooses to play the field

What are tier 1 lithium assets really worth? One Aussie mining explorer just turned down a $5.5 billion offer.

Liontown (ASX: LTR) rejected a $2.50 a share takeover bid from US commodities giant Albemarle earlier this week. (An eye-watering 63% premium to their last close.)

The news triggered a stunning share price rise of 68% — with Liontown becoming the most Googled stock on the ASX this week.

Turns out, the company knows when to turn down an opportunistic bid and play the long game.

Nice try, Albemarle. But it will take more to catch the interest of this Aussie lithium giant.

2. Hindenburg takes aim at another

Jack Dorsey’s Block fell into hot water with Hindenburg Research this week, striking a blow to the company’s share price (not to mention the Twitter co-founder’s net worth).

The activist short-seller released a two-year investigation into its popular pay-anyone service Cash App, alleging it facilitated fraud and other criminal activity.

Activist short-sellers, like Hindenburg Research, hold enormous power over company valuations.

The firm targeted about 30 companies over the past two years, including billionaire Gautam Adani’s empire. And their shares lost about 15% on average the next day.

The question is, who will be next on the chopping block?

3. Behemoth becomes six startups

Alibaba has unveiled a significant restructuring of its business, dividing the e-commerce behemoth into six distinct entities.

These individual units will now have the ability to raise their own capital — and potentially pursue their own IPOs in the future.

After spending more than a year abroad, it’s clear CEO Jack Ma has had a complicated relationship with the Chinese government and their crackdown on big tech.

But this week’s move is a sign he wants to stay on their good side.

4. It’s wedding season for the banking sector

First Citizens Bancshares (NASDAQ: FCNCA) swooped in to secure much of what remains of Silicon Valley bank in another forced marriage between two major banks.

The sale marks a milestone in the regulatory crusade to clean up the aftermath of two of the most colossal bank failures in history.

And with investors currently on edge about the global financial system’s stability, markets have welcomed the rescue.

5. Is Lululemon insulated from recession?

Its CEO seems to think so.

Lululemon shares (NASDAQ: LULU) stretched well beyond expectations this week, after the yoga-wear retailer revealed healthy revenue in Q4. But other high-performing retailers, like Nike, have a more conservative outlook.

But considering sales were down for the broader athletic apparel industry, the positive figures had CEO Calvin McDonald in high spirits.

Become a part of

our investors' community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.