Scan this article:

Hey Superheroes,

Both the U.S. and AU markets turned bearish this week after several weeks of strong gains. Experts attributed the recent market weakness to U.S. inflation running hotter than expected.

On the other hand, we’ve seen increased trading activity around Bitcoin ETFs this week – is it perhaps due to Bitcoin hitting US$73,000 for the first time this Wednesday?

Either way it was an eventful week! Here are the stories you need to know.

Xiaomi jumps on the electric vehicle bandwagon

Xiaomi, one of China’s largest producers of smartphones, announced that it will start deliveries of its first ever electric vehicle this month.

🚗 Challenging Tesla and Porsche EVs?!

While not listed on the U.S. markets, Xiaomi’s entry into the industry comes at a time of intensifying price wars between EV producers.

Tesla, Nio and BYD are among those that have already slashed prices a few times, a decision that has inevitably affected bottom lines.

Furthermore Xiaomi believes that its SU7 is capable of accelerating faster than some of Tesla’s and even Porsche’s EVs. Now that would be a sight to behold.

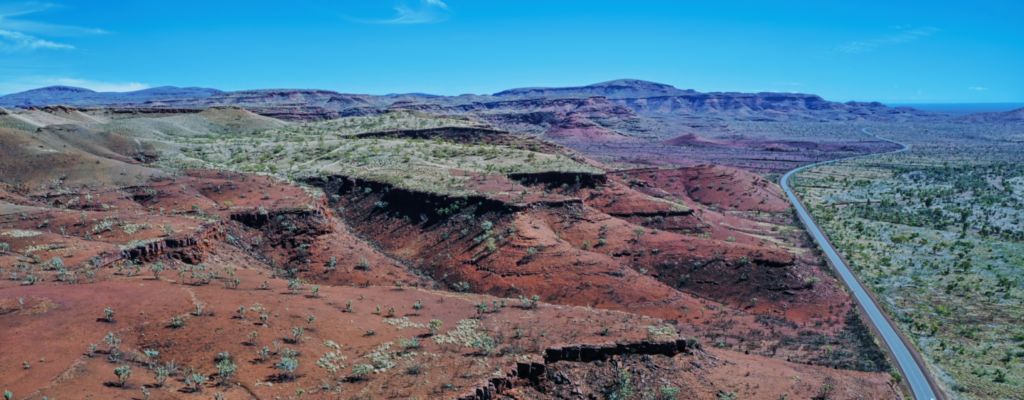

Liontown Resources obtains funding needed to begin production

Following the abandonment of its takeover deal from Albemarle (NYSE:ALB) in October, Liontown had been on a mission to obtain funds to get its Kathleen Valley project finally running.

At the time, several of Australia’s big banks showed interest that led to Liontown negotiating a total debt deal of A$760M.

⛏️ Falling lithium prices scared investors away

However, falling lithium prices led to several re-negotiations of the debt deal. Westpac, ANZ and HSBC were among those who pulled out of the agreement completely.

During this time, Liontown’s share price fell over 50% as the market digested worries around the miner’s future. The lithium project required start-up costs of about A$951M to get it into production – an amount that Liontown could not cough up on its own.

Fortunately an agreement was finally signed this week – with Liontown obtaining a debt deal to the amount of A$550M. While lower than initially agreed on, the company’s CEO says that the loan is enough for it to start producing by mid-year.

Liontown’s share price rose 15% straight after the news was announced.

🔦 Some other things we’re shining the Spotlight on:

- APPEN’S EXPOSED SECRET: In response to an ASX inquiry into its recent share price gains, Appen was forced to reveal a ~A$154M takeover bid from Innodata (NASDAQ:INOD). Innodata withdrew the offer straight after, citing a breach of confidentiality.

- ARAFURA’S VOTE OF CONFIDENCE: Arafura Rare Earths jumped over 80% yesterday after news of a A$840M investment from none other than the Federal Government of Australia. The Albanese government believes that the Arafura project would help “secure Australia’s position as a renewable energy superpower.”

- NEW MINER ON THE ASX: Litchfield Minerals (ASX:LMS) debuted on the ASX after a successful IPO that raised A$5M at A$0.20 per share. The miner operates two projects in the Northern Territory, which it believes to hold future mining potential for copper, uranium, manganese and rare earths.

All eyes will be on the Fed and RBA interest rate decisions next week. Keep up to date with market news and insights by following us on Instagram, @superheroau!

That’s all for this week’s Spotlight!

Become a part of

our investors' community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.