Scan this article:

Australia’s most popular ETF (ASX:VAS) has a lot more competition this week with BlackRock and BetaShares announcing massive cuts to their fees for their rival products.

1. ETF wars

BlackRock and BetaShares are both slashing fees on their ETFs that track the ASX200. BlackRock led the charge by cutting the management fee on their ASX200 ETF (ASX: IOZ) product by 44% to .05%.

BetaShares responded by making their equivalent product (ASX: A200) the cheapest investment option in the market to track the ASX200 to .04%.

Vanguard’s Australian Shares Index ETF (ASX: VAS) is Australia’s most popular ETF that tracks the ASX300 with a whopping $12.2 billion under management. So far Vanguard has made no noises about reducing their fees, but we’re loving the competition.

2. Big Red History

From May 1st current Coles CEO, Steven Cain, will be passing the baton to its new CEO, Leah Weckert. Currently the chief of the retailers commercial and express divisions, she’s also held roles across finance, marketing, people and culture and as the Victorian General Manager.

She will be the first female CEO ever of the 109-year-old company, taking over after a turbulent period for Coles with the demerger from Wesfarmers in 2018, a pandemic and recently high-inflation causing skyrocketing prices.

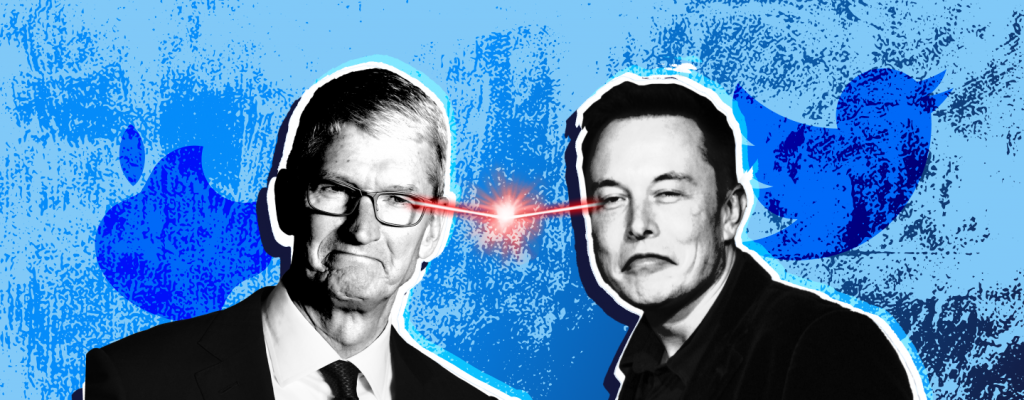

3. #verified

Meta is following the lead set by Twitter and will begin testing their own pay-for-verification service.

The new subscription service is called Meta Verified and with it you’ll get the coveted blue checkmark, impersonation protection, access to support, greater visibility along with access to exclusive features. It is rolling out across ANZ as a global test market this week as it hopes to build a new recurring revenue stream.

4. Deep cuts

Softening commodity prices and soaring costs have resulted in BHP and Rio Tinto cutting their dividends.

BHP saw year-on-year profits fall 32% forcing a 40% reduction in its dividend. Rio Tinto reported net earnings 41% lower than 2021 resulting in dividends being cut in half. It’s worth noting that Rio’s dividend is still above expectations and historically high, however it’s a sharp decrease from last year’s record breaking payout.

5. Sky high profits

Qantas has delivered a record $1.4 billion pre-tax profit and announced a $500 million share buyback.

The good news came from revenue tripling due to higher demand and increased ticket prices. This is a major turn around from the $1.2 billion loss from the previous year.

Qantas’ CEO, Alan Joyce, said that fare prices should start to come down as supply chain and resource issues begin to unwind.

Become a part of

our investors' community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.